In today's rapidly evolving educational landscape, the integrity and security of private school operations have never been more critical. As administrators, we strive to cultivate environments where trust and transparency are paramount. However, my own experience transitioning a school from paper-driven to digital bookkeeping revealed just how vulnerable these systems can be. The school's petty cash account was a constant source of frustration, impossible to balance due to a complete lack of controls. This article delves into the multifaceted issue of employee theft within private schools, exploring its various forms, the risks it presents, and the profound impact it can have on both finances and reputation. By understanding these dynamics, we can better equip ourselves with the strategies and tools necessary to safeguard our schools and uphold the principles we hold dear.

A Trustee's responisibility.

You have spent a year as a trustee of St. Etheldreda's. You have attended all the meetings. Recently you were appointed to the finance committee. The nagging question keeps chewing at you. "How do we know that our employees aren't stealing from us?" After all, hardly a day goes by without yet another report on the news of some trusted employee stealing from one organization or another.

You simply have to ask these tough questions of your business manager and your auditor.

1. Does one person have control over all of your accounting functions?

2. Are two signatures required on checks over a pre-determined amount - say, $50?

3. Are checks ever pre-signed?

4. Are your bank accounts consolidated so that your bookkeeping accurately reflects the school's true financial position?

5. Is there petty cash lying around?

6. Are different people assigned to the deposit and account reconciliation functions?

7. Do you have a purchase order system?

8. Does your committee review expenses and supporting vouchers carefully and frequently?

10. Do you run background checks and speak to references before you hire?

Insist that your school be run like a business

Some schools find it difficult to implement standard business practices. Even when they do, they can find it even more difficult to stick to those practices. Be careful of the trusted old employee who's been there forever and resists your updated business procedures. Reassigning him or her to some other function and bringing in some new blood is probably a good idea. Off the shelf accounting software such as QuickBooks makes short work of financial reporting and day-to-day management.

Constant vigilancel!

Part of your fiduciary responsibility as a trustee is to observe. Ask lots of questions. Insist on answers. People are less likely to steal if they know they are being watched. School trustees hold a fiduciary responsibility to act in the best interests of the institution they serve, ensuring that resources are managed effectively and ethically. Passivity and ignorance of the law are no excuses for avoiding this responsibility, as trustees are expected to be proactive and informed, making decisions that uphold the school's mission and financial integrity. Failure to fulfill these duties can lead to legal consequences and undermine the trust placed in them by the school community.

Require an annual audit.

For any 501(c)(3) not-for-profit organization, conducting an annual audit by a professional Certified Public Accountant (CPA) is crucial. This audit not only ensures compliance with financial regulations but also demonstrates the organization's commitment to transparency and accountability. Charity evaluation organizations, such as Charity Navigator, closely scrutinize audited financial statements to assess a charity's financial health and operational integrity. A professional audit reassures potential donors about the organization's bona fides, thereby enhancing trust and potentially increasing donations. By maintaining rigorous financial oversight through annual audits, not-for-profits can strengthen their reputation and secure their standing with both donors and regulatory bodies. Do not let the board skip the annual audit.

How to prevent fraud.

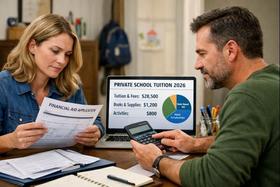

In a small school's back office, where typically one person manages all the accounts using an app like QuickBooks, implementing robust controls is essential to prevent fraud. Retaining a professional CPA to review the accounts monthly can provide an extra layer of oversight, ensuring that any discrepancies are promptly addressed. Additionally, instituting a policy that requires two signatures for payments over a specific amount, such as $50, can significantly reduce the risk of unauthorized transactions. These measures, while straightforward, are vital in maintaining financial integrity and safeguarding the school's resources.

This video from the Associate Board of Fraud Examiners offers 5 steps to reduce fraud.

Conclusion

Running your school like the business it is not only ensures its financial health but also serves as a powerful educational tool for students and their parents. By embracing good business practices such as transparency, forecasting, and sustainability, you set a standard of excellence that resonates throughout the school community. This approach provides an unparalleled opportunity to teach valuable lessons about managing a business, demonstrating the importance of accountability and strategic planning. Encourage your school to adopt these principles, and watch as it transforms into a beacon of financial stewardship and educational innovation. Through this commitment, you prepare students for future success and instill a culture of integrity and responsibility that benefits everyone involved.

Questions? Contact us on Facebook. @privateschoolreview

#EmployeeTheft, #SchoolSecurity, #FraudPrevention, #PrivateSchools, #EducationSafety